| |||||||

|

Thursday, January 30, 2020

Latin People News LPN: Family Movie Nights: Aladdin

Latin People News LPN: Family Movie Nights: Aladdin: Bring your own blanket or chair and join your neighbors for Family Movie Nights in the park featuring Aladdin . ...

Publicado por LATIN PEOPLE NEWS

Juan Fanti - 200 Global Financial Solutions

en

Thursday, January 30, 2020

No comments:

Latin People News LPN: Celebrating 250 Years of Beethoven's Genius

Publicado por LATIN PEOPLE NEWS

Juan Fanti - 200 Global Financial Solutions

en

Thursday, January 30, 2020

No comments:

Latin People News LPN: You are invited to ART PALM BEACH 2020 opening 1/...

Latin People News LPN: You are invited to ART PALM BEACH 2020 opening 1/...: TICKETS ART PALM BEACH 2020 ART PALM BEACH celebrates its 23nd Edition at the Palm Beach County Convention C...

| |||||||

|

Publicado por LATIN PEOPLE NEWS

Juan Fanti - 200 Global Financial Solutions

en

Thursday, January 30, 2020

No comments:

Latin People News LPN: Updated Agenda with Panel Descriptions, 7th Annual...

Latin People News LPN: Updated Agenda with Panel Descriptions, 7th Annual...: 7th Annual Narcotics Conference "Drugged to Death" As Part of the Broward County Crime Commission Building B...

|

|

|

|

Publicado por LATIN PEOPLE NEWS

Juan Fanti - 200 Global Financial Solutions

en

Thursday, January 30, 2020

No comments:

Reparación de crédito: Cómo corregir los errores de tu informe de crédito

Reparación de crédito: Cómo corregir los errores de tu informe de crédito

16 de enero de 2020

por

Lisa Weintraub Schifferle

Abogada, División de Educación del Consumidor y Negocios, FTC

Si has estado leyendo nuestra serie de artículos de blog de año nuevo, crédito nuevo, entonces ya tienes tu informe de crédito y has aprendido a leerlo. ¿Pero qué tienes que hacer si encontraste errores? Quizás sea una cuenta que tú no abriste, un error en tu nombre o domicilio, o una bancarrota que en realidad no te corresponde. A continuación, algunas recomendaciones para corregir tu informe y, al mismo tiempo, evitar las estafas.

Si ves errores en tu informe, comunícate con la compañía de informes crediticios y la compañía que suministró la información. Pídeles a ambas compañías que corrijan sus registros. Incluye la mayor cantidad posible de detalles y agrega copias de constancias, como registros de pago o documentos de la corte.

Cuando te comuniques con la compañía de informes crediticios, el proceso dependerá de si eres una víctima del robo de identidad o si no lo eres:

Si los errores no están relacionados con el robo de identidad: Infórmale a la compañía de informes crediticios (por correo o en línea) cuáles son los datos que crees que son inexactos. Si te comunicas por correo, puedes usar nuestros modelos de cartas de disputa. Si lo haces en línea, usa los portales para disputas de cada compañía de informes crediticios (Equifax, Experian, Transunion) donde figure el dato inexacto. La compañía de informes crediticios debe investigar tu reclamo y hacer las actualizaciones necesarias de tu información dentro de los 30 días. La compañía de informes crediticios también debe comunicarse con la compañía que le suministró la información. Si la compañía que suministró la información descubre que era inexacta, debe notificar a las tres compañías de informes crediticios para que corrijan tu archivo.Si los errores se deben al robo de identidad: Tú puedes bloquear las deudas relacionadas con el robo de identidad para que no aparezcan en tu informe de crédito. Visita RobodeIdentidad.gov para enterarte de los pasos a seguir y para conseguir un Reporte de Robo de Identidad para enviárselo a las compañías de informes crediticios. Recuerda que puedes usar los reportes de robo de identidad únicamente para las deudas causadas por el robo de identidad. Es ilegal presentar un Reporte de Robo de Identidad para bloquear deudas que efectivamente adeudas.

Si estás considerando la idea de pagarle a una organización de reparación de crédito para que te ayude a reparar tu crédito, recuerda que todo lo que esa organización pueda hacer por ti de manera legal, tú puedes hacerlo por tu cuenta sin costo o pagando un pequeño cargo. Las organizaciones de reparación de crédito NO pueden eliminar legalmente la información negativa de tu informe de crédito que sea exacta.

Si contratas una organización de reparación de crédito, evita hacer trato con aquellas organizaciones que:

Te insistan para que pagues antes de brindarte ayuda (eso es ilegal).Te digan que no te comuniques directamente con las compañías de informes crediticios.

Disputen información de tu informe de crédito que tú crees que es exacta.

Si tienes un problema con una organización de reparación de crédito, repórtalo ante la FTC. Para más recomendaciones, lee Reparando su crédito, Reparación de crédito: Cómo ayudarse a sí mismo y Estafas de reparación de crédito.

Publicado por LATIN PEOPLE NEWS

Juan Fanti - 200 Global Financial Solutions

en

Thursday, January 30, 2020

No comments:

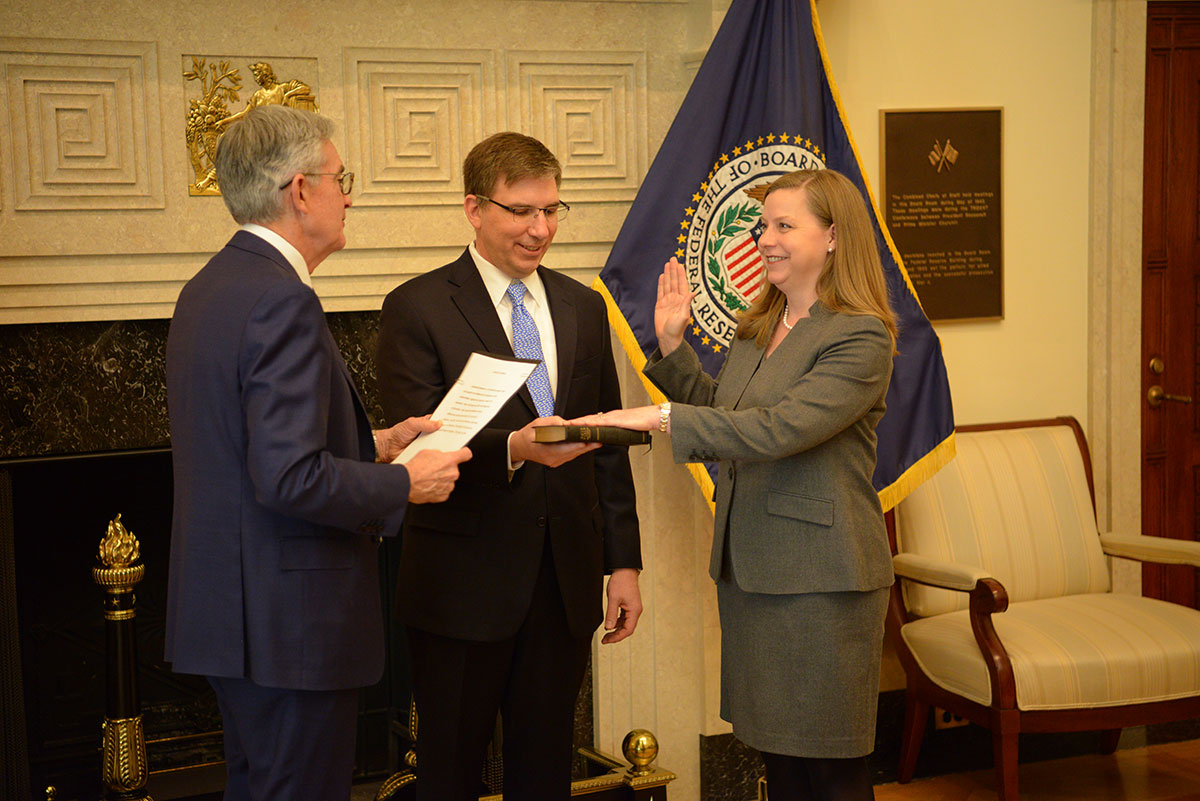

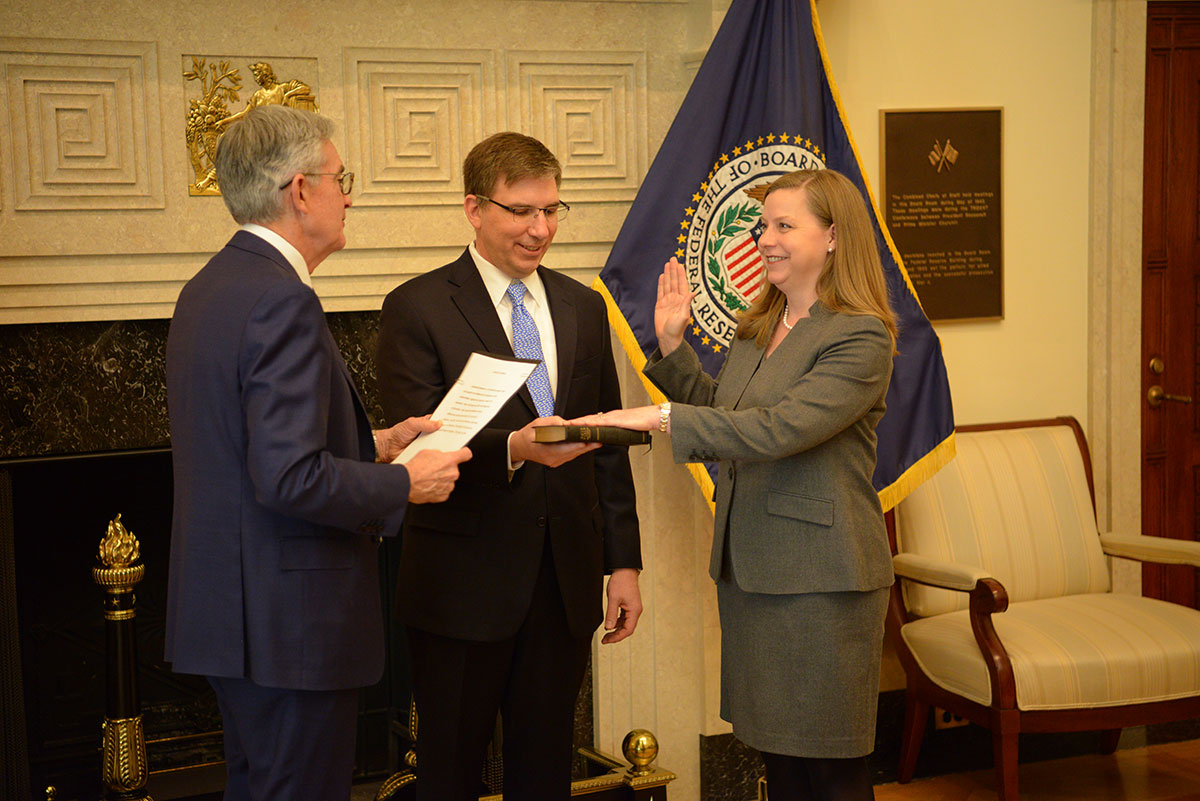

Latin People News LPN: Michelle W. Bowman sworn in for second term as mem...

Latin People News LPN: Michelle W. Bowman sworn in for second term as mem...: January 30, 2020 Michelle W. Bowman sworn in for second term as member of the Board of Governors of the Federal Reserve System For imm...

January 30, 2020

Michelle W. Bowman sworn in for second term as member of the Board of Governors of the Federal Reserve System

For immediate release

Chair Powell swears in Michelle W. Bowman as a member of the Board of Governors of the Federal Reserve System.

Michelle W. Bowman was sworn in for her second term as a member of the Board of Governors of the Federal Reserve System on Thursday. The oath was administered by Chair Jerome H. Powell in the Board Room.

President Trump renominated Governor Bowman for a full term on April 4, 2019. Governor Bowman was reconfirmed as a Board member by the United States Senate on September 12, 2019, and her term expires on January 31, 2034. Governor Bowman first took office as a member of the Board of Governors of the Federal Reserve System on November 26, 2018, to fill an unexpired term ending January 31, 2020.

A biography of Governor Bowman is available on the Board's website: www.federalreserve.gov/bios/.

Publicado por LATIN PEOPLE NEWS

Juan Fanti - 200 Global Financial Solutions

en

Thursday, January 30, 2020

No comments:

Latin People News LPN: How to Check your Consumer Reports

Latin People News LPN: How to Check your Consumer Reports: Good afternoon, You may know that your credit records affect your ability to get an affordable loan, a job, an apartment, or many other...

Good afternoon, You may know that your credit records affect your ability to get an affordable loan, a job, an apartment, or many other essentials of daily life. But, do you know where and how to actually request your credit reports and what you can do once you order them? Over the past few years, we have updated and published a list of consumer reporting companies. Today, we present you with the 2020 edition of our list. You can filter and search the list online. This year’s list includes the following features:

Download the list nowThank you, Consumer Financial Protection Bureau |

Publicado por LATIN PEOPLE NEWS

Juan Fanti - 200 Global Financial Solutions

en

Thursday, January 30, 2020

No comments:

Subscribe to:

Comments (Atom)